The logistics market is thriving boosted by a favourable economic backdrop stimulating exports, retail sales and consumer spending, according to the latest report by BNP Paribas Real Estate. The sale of major portfolios in Germany generated outstanding volumes of investment during the first half of 2017. Prime yields continued to decline, even though they have had already bottomed-out to their lowest level. Expectations across Europe in the forthcoming quarters point towards a return to the more average level of investment and further yield compression.

Key figures and facts:

Take-up: +22% in H1 2017 vs H1 2016

- Spain and the South Netherlands recorded the highest growth in Europe this semester

- Retail and e-commerce contribute to market growth in most countries

- Supply remains tight and new development barely keeps up with demand

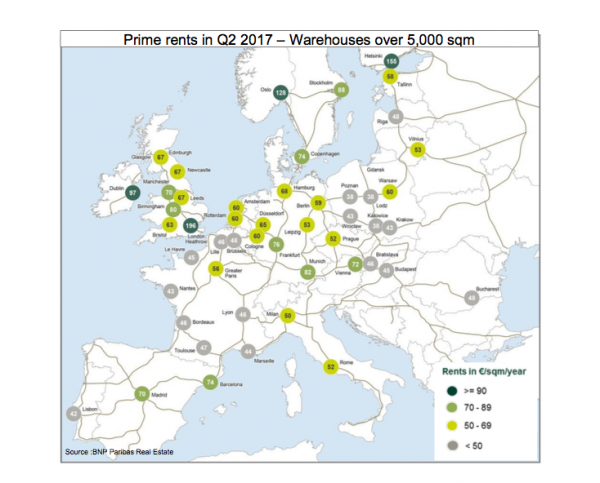

- Rents evolved only marginally

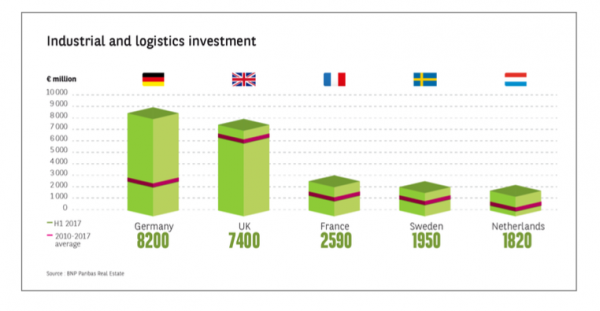

Yet again, strong industrial and logistics investment boosted by portfolio transfers

- €15.8bn invested in warehouses in H1 2017, above the historical volume recorded in H1 2016

- Investor interest for logistics is not fading

- Prime yields stabilized or declined to their lowest point reflecting the lack of investment products

- There is still some space for yield compression, particularly in secondary markets

Take-up: robust activity in H1 2017

Take-up for warehouses over 5,000 m² grew by 22% in H1 2017 compared to H1 2016 in the 21 cities regularly followed by BNP Paribas Real Estate. Besides stable activity in the two leading regions, namely Greater Paris and the Midlands, the market for warehouses over 5,000 m² was particularly buoyant in Madrid and in the South Netherlands. This can be largely attributed to positive economic momentum with good levels of exports, retail sales and consumer spending.

Germany is the largest occupier market in Europe boosted by the strong activity in its manufacturing industry and demand from logistics providers. For the third year in a row, the German market reached yet again the 2.5 million m² threshold of transaction of warehouses taken up in mid-year.

In France, demand for logistics premises remained robust to reach 1.56 million m² taken up in H1 2017. Even though the market declined by over 20% compared to the record numbers achieved in H1 2016, activity picked-up in Lille and Marseille and stayed strong in Greater Paris.

In the UK, the market has been slowing down in line with the economic slackening. Take-up decreased to 1.2 million m² in H1 2017 (-14% compared to H1 2016). The manufacturing sector accounted for the largest share of take-up boosted by the automotive sector, with some major transaction in the outskirts of Birmingham.

In Spain, take-up rose by more than 84% to reach over 660,000 m² in H1 2017. This merely represents the highest volume ever recorded in mid-year. The market in Madrid was particularly dynamic boosted by some large transactions over 40,000 m² (Amazon, DSV, Transaher).

In the Netherlands, the volume of take-up exceeded in six months the annual volume reached in 2016. In the Czech Republic and Poland, e-commerce and distribution for retailers is the main demand driver contributing to market growth. Low vacancy rates in Poland (5.9%) and the Czech Republic (4.0%) have been a motivator for new development schemes and build to suit.

Strong momentum for industrial and logistics investment

“Investors continue to show a strong interest for the logistics market. Indeed, the investment market for industrial and logistics premises increased by 10% during H1 2017. During the same period, European investment in offices decreased by 10% and retail by 7%. For the first time ever, the German industrial and logistics investment market recorded higher volumes than in the UK”, comments Logan Smith, Head of Logistics Investment for Europe at BNP Paribas Real Estate.

Germany was the largest industrial and logistics investment market in Europe with the volume recorded in the first half of 2017 well exceeding the annual historical levels of the past few years. It is simply the highest record volume ever recorded.

The UK market increased significantly (+18% on H1 2016) to €4.5bn invested despite the scarcity of products and a context of political and economic uncertainties. In France, the market weakened during the first half of the year reflecting a period of uncertainties surrounding the presidential elections. With the return of business confidence, the second half of the year is expected to be much more dynamic. In the Netherlands, the industrial and logistics market reached nearly €1.1bn, representing 18% of the total volume of commercial real estate.

In Spain, the market continued to be thriving following the massive rebound in 2015 and 2016. The volume of industrial and logistics investment remained high with €480m reached in H1 2017. In Poland, investment activity for industrial and logistics was particularly slow after the record year 2016 and the prime yield stabilised at 5.5% in Warsaw. In the Czech Republic, after a strong activity at the end of 2016 supported by portfolio transfers, industrial and logistics investment was mainly concentrated in Prague in H1 2017.