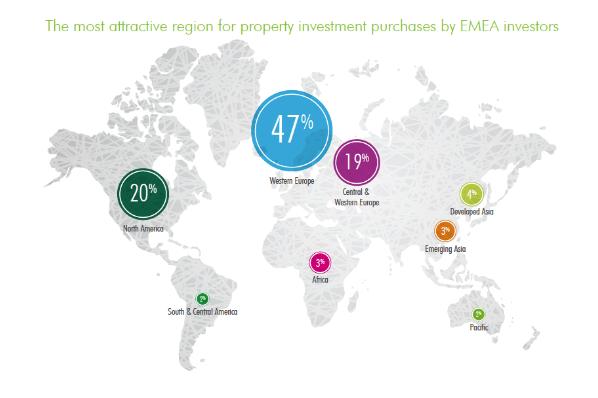

EMEA property investors are looking more widely across EMEA for investment opportunities, according to CBRE’s EMEA Investor Intentions Survey 2016. CBRE requested selected members from their client list across the EMEA property investment community to participate in an online survey of investor intentions 2016.

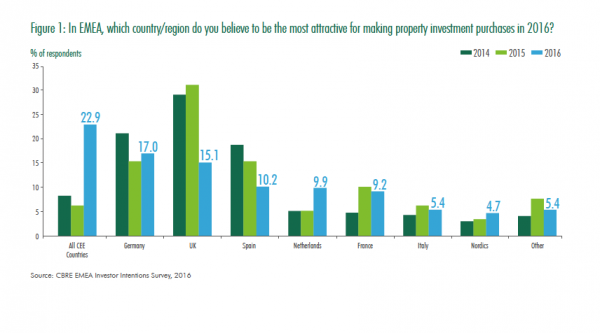

Respondents were asked which country they thought most attractive for investment, 42% of respondents picked the top three countries (UK, Germany and Spain). In 2015 that statistic was 61% and in 2014 these top three choices accounted for 70% of replies. This is also evident in the cities that investors think are most attractive for investment. Between them, our respondents mentioned 53 different cities, and the concentration of responses is far less pronounced than in previous years.

In addition, the survey found improvement in investor sentiment towards Central & Eastern Europe (CEE), with a big increase in the numbers picking CEE countries as the most attractive country and CEE cities as the most attractive city. It looks as though pricing may be the driver for this. H2 2015 saw prime yields in continental Western Europe fall very sharply, converging with earlier falls in the UK. This has left behind yields in CEE markets and the yield gap between CEE and Western Europe has increased markedly. The search for yield also shows through in sector choice, with 56% of our respondents already invested in one or more ‘alternative’ sectors and 57% actively looking in one or more of these sectors.

To find out more, download CBRE's EMEA Investor Intentions Survey 2016