According to the latest research by CBRE, Retail Chains in the Wake of Demand Changes, mass-market and economy retailers are actively developing their chains: they account for nearly 65% of all new store openings in 2016. Middle price chains account for.34% of the planned expansion volume, while middle+ and premium account for only 0.2% and 0.7% respectively.

The report analyses 53 biggest retail chains that have publicly announced their development plans as a result of changes in customer demand.

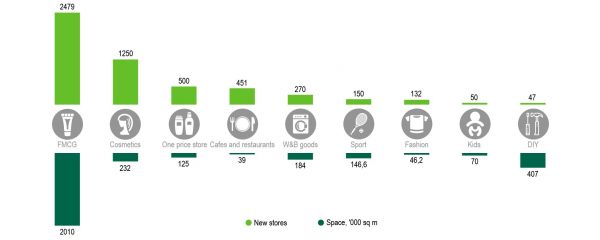

Planned number of new stores of existing retailers by segment

FMCG is the most active segment of the Russia’s retail market, the biggest food chains declared plans to open 2,479 stores with total area of more than 2 million m² in 2016.

Opening of about 2,072 stores is announced by the market leaders, Magnit and X5 Retail Group. Magnit intends to open 80 hypermarkets and 950 neighbourhood stores, while X5 Retail Group – 1,000 Pyaterochka stores, 37 Perekrestok stores and 5 Karusel hypermarkets. This is less than a year earlier – 1,476 and 1,144 respectively. At the same time Magnit is actively developing neighbourhood cosmetics store chain – about 1,200 units are to be opened by the end of 2016.

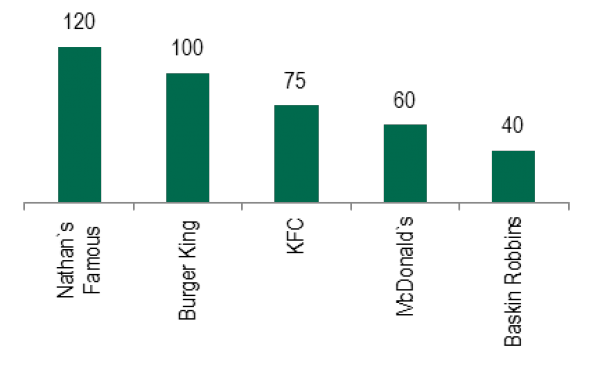

International fast-food chains is the most dynamic sector of F&B market in Russia. In total they are planning to open around 450 cafes by the end of 2016.

Planned number of new restaurants of present F&B retailers, 2016

Russian market is still very attractive for the international brands. Specifically, Moscow is still attractive for new players, as it is the major point of entry to the Russian market, and was ranked the 5th globally by the number of new foreign brands that entered the market in 2015.

Out of 33 new brands that have announced plans to enter the Russian market, 20 have already entered. The most active are fashion retailers – 11 brands have already entered or are planning to enter the market in 2016, and more than 50% of those companies are middle+ and premium brands.

New foreign brands in Russia in 2016

|

Entered the market |

Brand |

Sector |

Country |

|

Veta |

Fashion |

Estonia |

|

|

Charlotte Olympia |

Fashion |

Great Britain |

|

|

Burvin |

Fashion |

Belarus |

|

|

Fujifilm |

Electronics |

Japan |

|

|

Holika Holika |

Cosmetics |

South Korea |

|

|

Rolex |

Accessories |

Switzerland |

|

|

Kidzania |

Entertainment |

Mexico |

|

|

Ladurée |

Restaurants |

France |

|

|

Urban Decay |

Cosmetics |

USA |

|

|

Barbour |

Fashion |

Great Britain |

|

|

Lion of Porches |

Fashion |

Portugal |

|

|

Newby London |

Accessories |

Great Britain |

|

|

Victoria’s Secret |

Underwear |

USA |

|

|

Armani Exchange |

Fashion |

Italy |

|

|

Demurya |

Fashion |

France/Russia |

|

|

John Varvatos |

Fashion |

USA |

|

|

|

Kiko Milano |

Cosmetics |

Italy |

|

|

O bag |

Accessories |

Italy |

|

|

Amsterdam Chips Company |

Restaurants |

Netherlands |

|

|

Nature Republic |

Cosmetics |

South Korea |

|

Plan to enter the market |

Brand |

Sector |

Country |

|

Bric's |

Accessories |

Italy |

|

|

Cofix |

Restaurants |

Israel |

|

|

Cortefiel |

Fashion |

Spain |

|

|

Hunkemoller |

Fashion |

Netherlands |

|

|

Lillapois |

Drogerie |

France |

|

|

Tallinder |

Fashion |

Poland |

|

|

Undiz |

Accessories |

France |

|

|

Walt Disney |

Kids |

USA |

|

|

LULU |

Cosmetics |

France |

|

|

Hofbrauhaus |

Restaurants |

Germany |

|

|

Presse Café |

Restaurants |

Canada |

|

|

EGLO |

Home goods |

Austria |

|

|

|

Loriblu |

Fashion |

Italy |

Olesya Dzuba, director of research department CBRE in Russia said: “Thus, the analysis of retail chains’ development plans has shown a direct correlation: the reduction of retail trade volume and stiffer competition give a head start for the largest retail chains, which use the current situation to increase their market share. The brightest examples are retail chains that have own production and logistics platforms enabling them to easily adjust assortment and prices.”