Prime yields in up to six sectors of the UK commercial property market could well harden before the year is out, says Savills, as the weight of overseas investment targeting the UK maintains current pricing.

The international real estate advisor says that foodstores have become the latest sector where prime yields are expected to harden in 2017, joining M25 offices, regional offices, retail warehouse (restricted), industrial distribution and industrial multi-lets. Investor interest in the sector has been boosted by improved operator performance and the long index linked leases common to the sector but also the additional residential play offered by under-utilised foodstore sites in Greater London and the south east of England, says Savills.

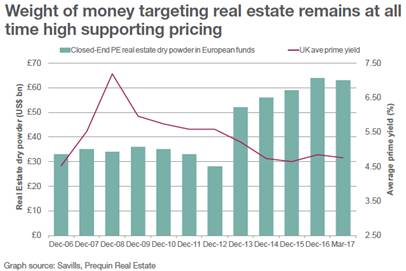

UK Q1 transaction volumes totalled €14.8bn (£12.9bn) - 20.5% higher than the 10 year first quarter average - largely driven by activity in the London office and industrial markets. There is an additional c. €220bn ($247bn) of capital sitting in private equity real estate funds yet to be deployed, with c. €56.1bn ($63bn) of this related to European funds.

Mark Ridley, CEO of Savills UK and Europe, says: “With currency forecasts suggesting that the pound will remain relatively weak against the euro and dollar over the short term, overseas investor interest in the UK will continue. The weight of undeployed capital from overseas investors is helping to maintain current pricing and may even translate into yield compression in some of the six sectors currently under pressure.”

Marie Hickey, director in the commercial research team at Savills, adds: “Any compression in foodstore yields will come on the back of some relatively difficult years where negative newsflow around the operational performance of the 'Big Four' saw yields drift out in 2014. However, it’s not just improved operator performance that is luring investors back. Adding residential to sites in popular areas is one way for investors to deliver additional value, but the long inflation linked leases common to the sector have also increased its attractiveness particularly as investor appetite for 'risk' has waned in the aftermath of the Brexit vote.”