BMO Real Estate Partners has launched the second fund in its Best Value Europe series, Best Value Europe II, following seed commitments from repeat investors. This ensures BMO REP can continue capitalising on the strong pipeline of investments already established for the Fund, following its initial acquisitions of two prime assets in Verona and Madrid for a total of circa €39m.

The short-term objective for the Fund is a Gross Asset Value of €500m and then growing in the medium-term upwards of €1bn. Like its predecessor, which is now over 90% invested with a portfolio of 12 assets totalling over €700m, BVE II will focus on selective, high-quality retail investment opportunities in prime shopping streets within major European cities.

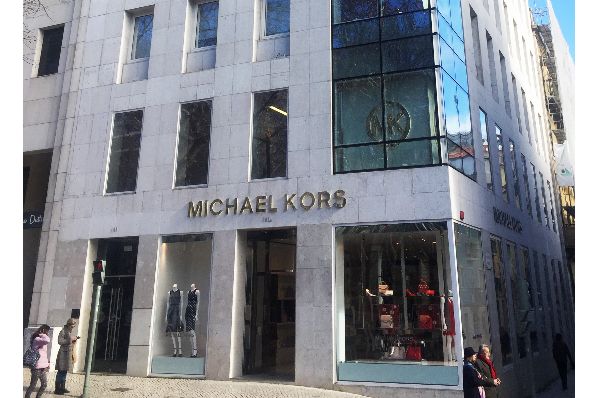

The third property acquired on behalf of the Fund is a trophy asset on Avenida da Liberdade 108, Lisbon’s top luxury shopping destination. The property has been acquired, off the market for €15.2m. The asset is a fully refurbished mixed-use building comprising 2,104 m², including offices and a retail unit which is let to Michael Kors.

Ian Kelley, Fund Director Europe at BMO Real Estate Partners said: “We have a long-term commitment to our specialised high street retail strategy and BVE II will enable us to continue taking advantage of the many opportunities we are seeing across Europe that we believe will deliver attractive returns. Having expanded our team in Paris, we are in an even stronger position to execute our on-the-ground approach in identifying and unlocking assets that meet our strict investment criteria.”

Iris Schoeberl, Managing Director Germany and Head of Institutional Clients at BMO Real Estate Partners, continued: “The launch of BVE II demonstrates our consistent track record in delivering returns in this specialised area of the retail market and one which we see as very resilient in the current climate, whilst offering a strong income based return. This focused investment strategy has resonated with our clients, who continue to support our approach through repeat investments.”